Business Funding Mistakes Every Consultant Should Avoid

Unlocking Organization Financing: Strategies for Sustainable Development in Your Consultancy

Gaining accessibility to company funding is a crucial variable for the lasting development of a consultancy. Many professionals battle to recognize their monetary needs and explore potential sources. Standard financing alternatives frequently feature rigorous needs, while alternative financing can be elusive. A well-crafted company strategy acts as a structure, yet it is only the start. Comprehending exactly how to build connections with capitalists and utilize modern technology can make a considerable distinction. What techniques can consultants employ to navigate this complicated landscape?

Understanding Your Financing Demands

Understanding funding requirements is important for any company looking for to grow or maintain its procedures. A complete assessment of these requirements permits services to recognize the resources required for numerous efforts, whether it be for growth, item advancement, or operational efficiency. This evaluation must include both long-term and temporary monetary objectives, enabling firms to prioritize their funding demands properly.

In addition, services should examine their present monetary scenario, including capital, existing debts, and income forecasts. This evaluation aids in determining the suitable quantity of financing needed and the prospective influence on the company's general economic wellness. By plainly understanding their funding requires, businesses can create a calculated plan that straightens with their development purposes. Eventually, this quality promotes informed decision-making, permitting for the option of suitable financing methods that can successfully support their aspirations without threatening financial security.

Exploring Conventional Financing Choices

Standard funding options play an important role in safeguarding funds for businesses. This includes comprehending the ins and outs of small business loan, the prospective benefits of subsidies and gives, and the understandings offered by financial backing. Each of these opportunities provides unique chances and challenges that entrepreneurs must very carefully take into consideration.

Financial Institution Loans Explained

Many entrepreneurs take into consideration bank car loans as a main financing choice as a result of their structured nature and established reputation. These finances give companies with a swelling amount of funding that must be settled over a predetermined period, typically with passion. The application process generally calls for comprehensive economic paperwork, including service plans and credit rating, permitting financial institutions to analyze threat properly. Rate of interest can vary based upon the customer's creditworthiness and the general market conditions. While financial institution car loans enable accessibility to considerable funds, they additionally impose strict payment timetables, which can strain capital. Entrepreneurs should weigh these benefits and downsides carefully to identify if a small business loan straightens with their long-lasting development methods and financial capacities.

Grants and Subsidies

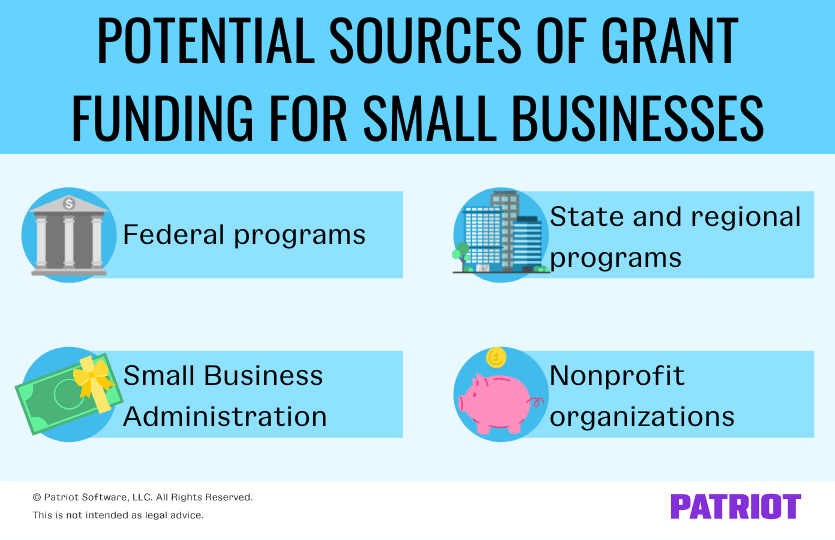

For businesses seeking option funding grants, options and aids present an engaging method. These monetary resources, frequently offered by federal government entities or nonprofit companies, do not require repayment, making them an appealing selection for working as a consultants going for lasting growth. Grants are usually awarded based on specific criteria, such as project propositions or area influence, while subsidies might sustain recurring functional costs, such as staff member training or research study and advancement. To access these funds, services need to browse application processes that may include in-depth proposals and economic paperwork. Recognizing qualification demands is essential, as competition for these resources can be tough. Eventually, leveraging grants and aids can appreciably enhance a consultancy's monetary security and capability for advancement.

Endeavor Capital Insights

How can companies properly harness financial backing to fuel their development? Venture resources (VC) serves as a crucial financing choice for start-ups and increasing consultancies seeking substantial funding mixtures. By engaging with VC companies, businesses access not just to financing but likewise to useful mentorship and industry links. To attract financial backing, business should provide engaging company versions, show market capacity, and emphasize solid management teams. In addition, understanding the expectations of investor concerning equity stakes and roi is essential - Business Funding. Developing a clear departure technique can further boost charm. Ultimately, leveraging venture resources needs a calculated alignment of objectives, guaranteeing that both parties share a vision for sustainable development and lasting success

Leveraging Choice Funding Resources

In the domain of organization funding, different resources present distinct opportunities for business owners. Crowdfunding platforms permit businesses to engage straight with potential clients, while angel investors offer not just resources but additionally useful networks and mentorship. By embracing these options, startups can enhance their economic strategies and boost their opportunities of success.

Crowdfunding Opportunities Available

What innovative methods can business owners check out to protect funds for their ventures? Crowdfunding has actually emerged as a sensible option funding source, enabling entrepreneurs to use a diverse pool of prospective financiers. Systems such as Kickstarter, Indiegogo, and GoFundMe allow businesses to present their ideas directly to the general public, generating interest and economic support. This approach not just gives resources however additionally acts as an advertising tool, verifying ideas via community engagement. Business owners can leverage rewards-based crowdfunding, offering services or products for contributions, or equity crowdfunding, where capitalists obtain a stake in the venture. By effectively connecting their vision and building a compelling project, business owners can harness the power of crowdfunding to facilitate sustainable Click This Link growth in their consultancies.

Angel Investors and Networks

Angel investors represent a crucial source of funding for entrepreneurs seeking to release or broaden their endeavors. These high-net-worth individuals give not only financial support but additionally indispensable mentorship and industry connections. By spending their individual funds, angel capitalists typically load the void that conventional financing methods, such as bank finances, can not resolve due to rigorous demands.

Entrepreneurs can improve their chances of bring in angel investment by joining networks that help with introductions between start-ups and capitalists. These networks commonly organize pitch events, offering a system for business owners to display their concepts. Structure partnerships within these networks allows business owners to use a riches of sources, guidance, and potential partnership, eventually driving sustainable development and technology in their consultancies.

Crafting a Compelling Business Plan

While several entrepreneurs comprehend the value of an organization strategy, few recognize that an engaging document can considerably influence funding possibilities. A well-crafted company strategy acts as a roadmap, outlining the vision, objectives, and methods of the consultancy. It should clearly detail the target audience, affordable landscape, and distinct worth recommendation, permitting prospective financiers to realize the consultancy's possibility for development.

Financial estimates, consisting of revenue forecasts and break-even evaluation, are important in showing the business's viability. Business Funding. Furthermore, an extensive risk analysis highlights awareness of potential challenges and outlines mitigation approaches, instilling confidence in financiers

The exec summary, usually the initial section read, need to be concise and appealing, enveloping the significance of the strategy. By concentrating on quality, logical structure, and compelling stories, entrepreneurs can create a persuasive service strategy that not only brings in financing however additionally lays the foundation for sustainable growth in their consultancy.

Building Solid Relationships With Investors

Networking is an additional vital aspect. Business owners must attend sector events, take part in on-line discussion forums, and utilize common connections to promote relationships with prospective investors. Individualized communication can likewise make a substantial impact; tailoring messages to reflect a capitalist's choices and passions demonstrates genuine consideration.

Comprehending an investor's goals and straightening them with the working as a consultant's vision can develop a much more compelling collaboration. By concentrating on common benefits and shared values, entrepreneurs can reinforce these necessary connections, ensuring that financiers stay engaged and helpful throughout the company's development trip. This structure is critical for lasting success in the competitive consulting landscape.

Using Financial Modern Technology Tools

As organizations increasingly look for cutting-edge methods to protect financing, utilizing monetary modern technology devices has actually emerged as a crucial method. These devices use structured procedures for handling finances, making it possible for consultancies to make informed choices promptly. Platforms for crowdfunding, peer-to-peer lending, and electronic repayment remedies allow businesses to access diverse funding resources, decreasing dependence on traditional financial institutions.

Economic innovation tools enhance transparency and improve communication with possible capitalists. By using data analytics, consultancies can present engaging economic forecasts and development methods, raising their interest funders. Automated budgeting and forecasting tools additionally make it possible for companies to handle resources effectively, making sure that funds are alloted where they can create the most impact.

In enhancement, monetary innovation remedies can help with far better capital monitoring, allowing consultancies to keep economic wellness while going after growth chances. By incorporating these devices into their funding techniques, organizations can place themselves for sustainable success in a progressively affordable landscape.

Surveillance and Adjusting Your Funding Technique

To guarantee lasting success, organizations have to constantly check and adjust their financing techniques in response to moving market problems and economic landscapes. This proactive technique allows firms to identify emerging possibilities and prospective dangers, guaranteeing their funding continues to be aligned with their critical goals. Consistently assessing monetary efficiency metrics, such as money circulation and profit margins, allows organizations to make educated choices regarding reapportioning resources or seeking new funding sources.

Additionally, remaining notified concerning market fads and competitor approaches is important. This understanding can guide adjustments to funding methods, whether with typical financings, venture capital, or alternative funding approaches. Involving with monetary consultants and leveraging economic innovation can enhance understandings into financing alternatives.

Ultimately, a dynamic funding method not just supports immediate needs but also placements companies for lasting growth, fostering resilience in an ever-changing industry. Versatility in funding practices is crucial imp source for maneuvering the intricacies of modern-day business atmospheres.

Regularly Asked Inquiries

What Common Mistakes Should I Prevent When Looking For Funding?

Common mistakes when looking for financing consist of inadequate study on possible investors, failing to articulate a clear worth proposition, ignoring economic forecasts, ignoring to prepare for due persistance, and not complying with up after initial conferences.

Exactly How Can I Establish My Consultancy's Financing Timeline?

To establish a consultancy's funding timeline, one ought to examine project demands, assess cash money circulation cycles, develop milestones, and consider exterior funding sources. This structured approach helps straighten financial goals with operational needs properly.

What Duty Does Credit Report Play in Funding?

Credit rating plays a vital function in funding by influencing loan providers' decisions. A higher score normally enhances qualification and terms, while a lower rating might restrict access to favorable financing options, impacting overall financing opportunities substantially.

Exactly How Do Financial Fads Influence Financing Availability?

Economic trends greatly influence funding schedule by impacting investor confidence, rates of interest, and lending methods. Throughout economic downturns, funding ends up being scarcer, while durations of development commonly result in boosted financial investment chances and more available financing alternatives.

Can I Secure Funding Without a Proven Performance History?

Securing financing without a tested track record is challenging but possible. Innovative ideas, solid organization plans, and reliable networking can attract capitalists prepared to take risks on unproven endeavors, especially in emerging markets or sectors.